On June 13, 2025, Israel launched a series of large-scale military strikes targeting Iran’s nuclear facilities, military infrastructure, and key personnel, escalating tensions in the Middle East to unprecedented levels. The attacks, which Israel described as a preemptive measure to curb Iran’s nuclear ambitions, killed senior military commanders and nuclear scientists, damaged critical infrastructure, and prompted Iran to retaliate with missile and drone barrages aimed at Israeli territory. This intensifying conflict has sent shockwaves through global markets, particularly the fertilizer sector, where Iran’s role as a major supplier of nitrogen-based fertilizers like urea has drawn heightened attention to wartime premiums and potential supply chain disruptions. The implications of the Israel-Iran conflict may have a ripple effect on the global fertilizer market, from the economic, logistical, and geopolitical standpoint, factors that may be drive wartime premiums.

The Middle East’s Critical Role in the Global Fertilizer Market

The Middle East is a powerhouse in the global fertilizer industry, particularly for nitrogen-based fertilizers such as ammonia and urea. In 2016, the region accounted for an estimated 17 million tons of ammonia production and 22 million tons of urea production, making it one of the largest producers globally. Iran, alongside Qatar and Saudi Arabia, is a leading exporter, with Iran alone responsible for approximately 16–17 million tons of urea exports annually, making it the world’s third-largest urea supplier. The region’s competitive advantage lies in its abundant natural gas reserves, a key feedstock for nitrogen fertilizer production, which allows for low-cost production and export-oriented operations.

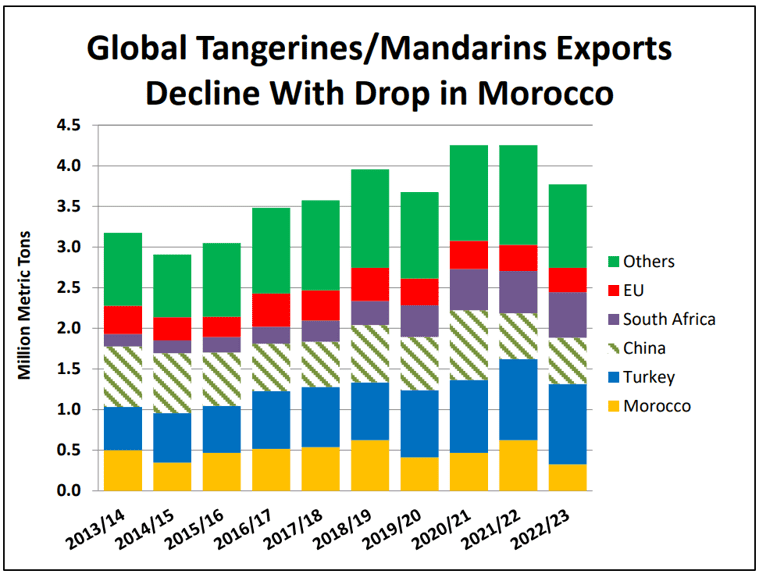

Iran’s fertilizer industry is particularly significant due to its strategic location and robust export capacity. The country’s urea exports primarily serve markets in India, Brazil, West Africa, and Southeast Asia, where agricultural demand for nitrogen fertilizers is high. However, the recent escalation of conflict with Israel threatens to disrupt this critical supply chain, raising concerns about global fertilizer availability and prices.

Immediate Market Reactions to the Israel-Iran Conflict

The Israeli strikes on Iran, which began early on June 13, 2025, targeted key nuclear sites, including the Natanz nuclear facility, as well as military bases and energy infrastructure vital to Iran’s economy. Iran’s retaliatory missile and drone attacks on Israel further intensified the conflict, raising fears of a broader regional war that could disrupt critical shipping lanes and energy supplies. These developments immediately impacted global commodity markets, with crude oil prices surging by 7% to $74.23 per barrel for Brent crude and $72.98 for U.S. crude on June 13. Fertilizer prices followed suit, as the Middle East’s role in both energy and fertilizer production amplified market volatility.

Industry analyses highlight the fertilizer market’s sensitivity to the conflict. For instance, while the initial Israeli strikes did not directly target fertilizer production facilities, the market reacted swiftly due to the region’s tight supply situation. Urea prices, already under pressure from reduced exports in other regions, surged as markets anticipated potential disruptions. Additionally, greater risk lies in potential disruptions to shipping lanes, particularly the Strait of Hormuz, rather than direct attacks on fertilizer plants.

Wartime Premiums and Their Impact on Fertilizer Prices

Wartime premiums—additional costs factored into commodity prices due to geopolitical risks—have become a focal point in the fertilizer market following the Israel-Iran conflict. These premiums reflect the increased uncertainty and potential for supply chain disruptions in conflict zones. In the fertilizer sector, wartime premiums are driven by several factors:

- Supply Chain Vulnerabilities: The Middle East, particularly the Persian Gulf, is a critical hub for fertilizer exports. The Strait of Hormuz, through which a significant portion of global oil and fertilizer shipments pass, is at risk of closure or disruption in a wider conflict. Analysts at RBC Capital Markets warn that Iranian retaliation targeting tankers, pipelines, or energy facilities could severely impact fertilizer exports. A closure of the Strait of Hormuz could increase nitrogen and potash prices by 15–30%, according to some estimates.

- Shipping and Insurance Costs: The conflict has already driven up freight rates and insurance premiums for cargo ships transiting the Persian Gulf and Red Sea. Earlier in 2025, sulfur prices from Iran surged from $130–135 per metric ton in March to $150–160 per metric ton in April due to limited port operations and higher insurance costs. Freight rates from the Middle East to Africa and Southeast Asia have risen by 25–30%, with insurance premiums doubling in some cases. These cost increases are passed on to fertilizer prices, exacerbating affordability challenges for importers.

- Market Sentiment and Speculation: The fertilizer market is highly sensitive to geopolitical developments. Even without direct damage to production facilities, the mere threat of escalation has driven speculative price increases. For example, the Iranian attack on Israel earlier in 2025, while not impacting fertilizer production directly, triggered a market response that reflected the tight global supply situation. This sentiment-driven volatility has led to higher urea, anhydrous ammonia, and urea ammonium nitrate (UAN) prices.

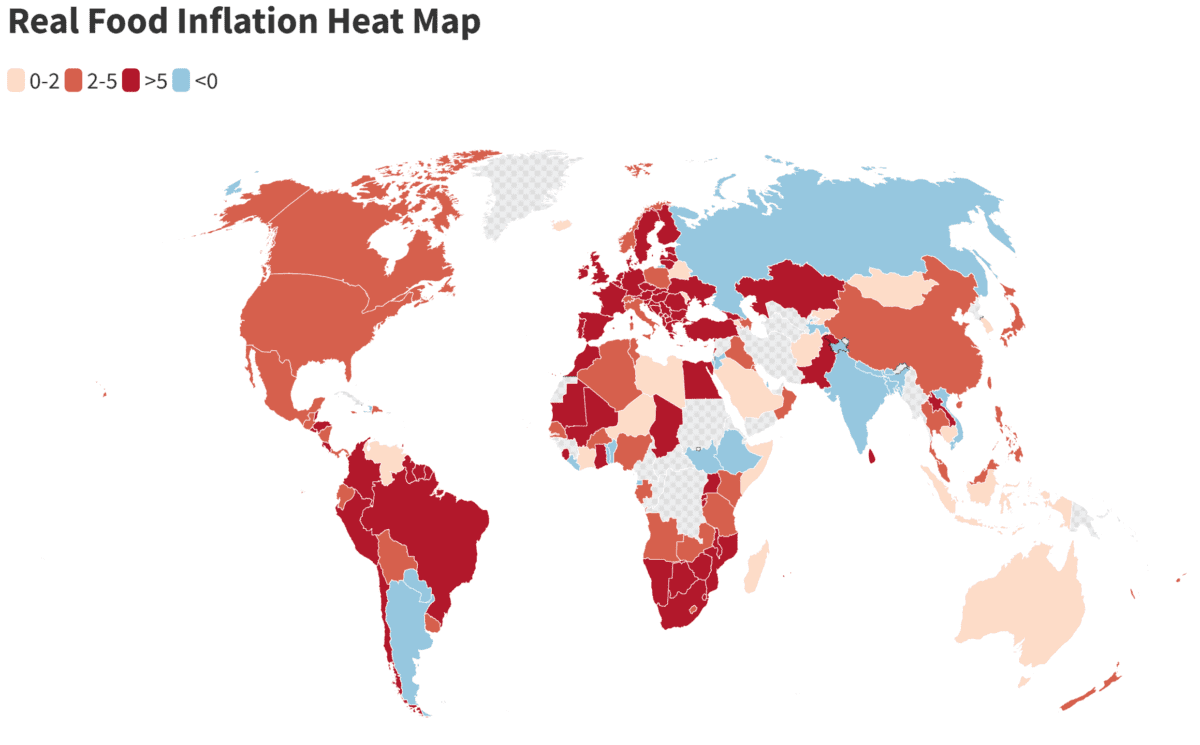

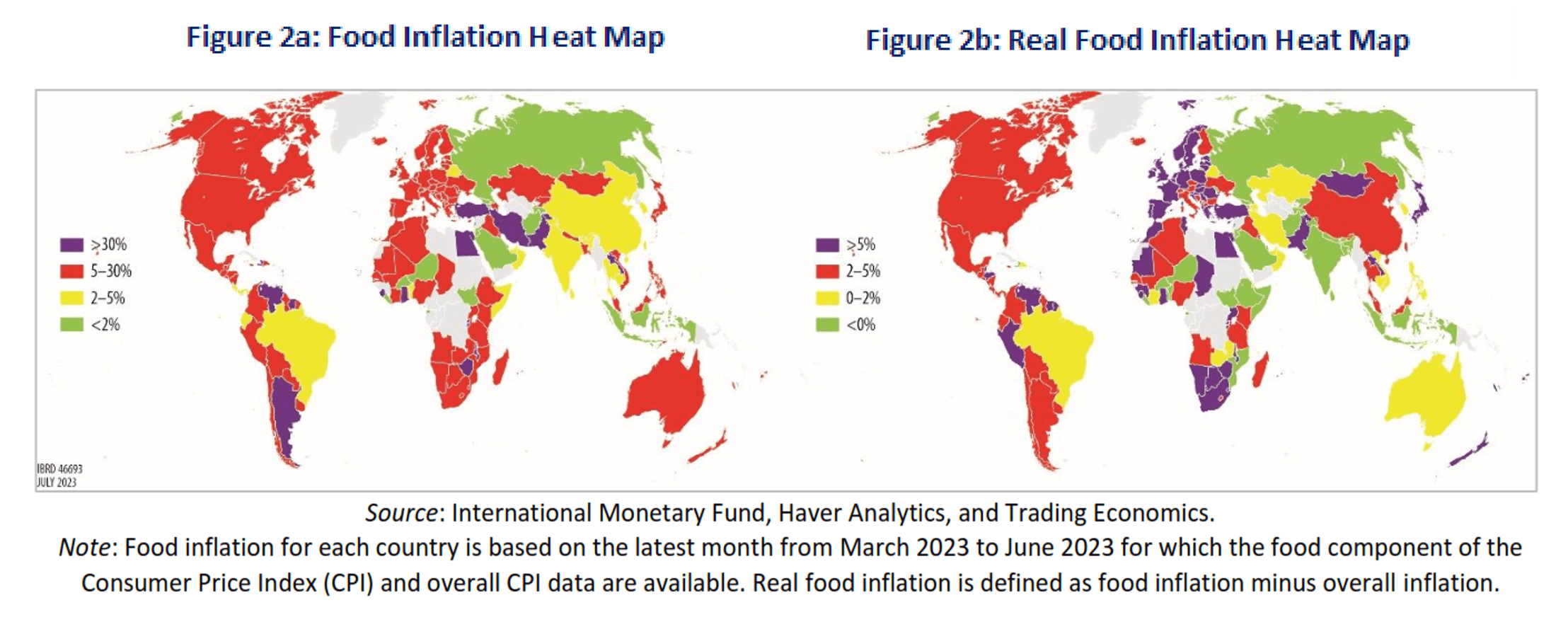

- Global Supply Constraints: The fertilizer market was already facing tight supply conditions before the Israel-Iran conflict. Reduced exports from countries like China and Russia, combined with regional production constraints in North Africa, had eliminated the global supply-demand gap. The conflict has further tightened this balance, pushing prices higher as importers scramble to secure supplies.

Regional and Global Implications

The Israel-Iran conflict’s impact on the fertilizer market extends beyond the Middle East, affecting agricultural economies worldwide. Key implications include:

- Impact on Importing Countries: Countries like India, Brazil, West Africa, and Southeast Asia, which rely heavily on Middle Eastern urea exports, are adjusting their strategies to mitigate risks. India, for instance, advanced its urea tender to secure April–May cargoes in anticipation of continued instability. Importers are increasingly requesting cost and freight (CFR) contracts with flexible laycan periods or free on board (FOB) terms to manage shipping risks.

- Agricultural Production Costs: Higher fertilizer prices directly increase input costs for farmers, potentially reducing crop yields or raising food prices. The Middle East’s arid climate and reliance on fertilizers for agricultural productivity make the region’s role in global food security critical. Iran and Turkey alone account for over 50% of urea consumption in the Middle East, and disruptions could exacerbate food security challenges.

- Alternative Suppliers: While other Middle Eastern producers like Qatar and Saudi Arabia could partially offset disruptions in Iranian exports, their capacity to fully compensate is limited. Egypt, another regional producer, has faced its own gas supply constraints, though new gas discoveries and imports from Israel and Cyprus may bolster its production in the long term. However, these alternatives cannot immediately replace Iran’s export volume.

Geopolitical and Economic Context

The Israel-Iran conflict is rooted in decades of hostility, with Iran’s nuclear ambitions and support for proxy groups like Hezbollah and the Houthis at the core of tensions. Israel’s strikes, dubbed “Operation Rising Lion,” aimed to cripple Iran’s nuclear program and military capabilities, with Prime Minister Benjamin Netanyahu stating that the operation would continue “for as many days as it takes” to neutralize the Iranian threat. Iran’s retaliatory missile strikes, which targeted Israeli military assets but caused limited damage, underscored the risk of a prolonged conflict.

The conflict has also disrupted diplomatic efforts to address Iran’s nuclear program. Talks between the United States and Iran, scheduled to resume on June 15, 2025, in Oman, were canceled following the strikes. The United States, while denying direct involvement in Israel’s attacks, has moved military assets to the region to protect its interests and support Israel, raising the specter of a broader regional conflict.

From an economic perspective, the fertilizer market’s vulnerability to Middle Eastern instability is not new. Previous conflicts, such as the 1973 Arab oil embargo and the 1979 Islamic Revolution in Iran, led to significant energy and fertilizer price spikes. The current situation echoes these historical precedents, with analysts warning that a prolonged conflict could have a “material impact” on the global economy.