Blockchain technology is shaking up the agriculture industry with its revolutionary approach to recording transactions and accounts. Dubbed the “blockchain ledger,” this distributed system is gaining popularity as a tool for promoting transparency and accountability.

Gone are the days of costly data storage. Blockchain technology has the potential to revolutionize the way we store and access information about inventory, farm operations, and the overall status of the agriculture sector.

With blockchain, tracking the source of agricultural products is now a breeze. This means that farmers, customers, and everyone in between can have confidence in the quality of the food supply chain.

But that’s not all. Blockchain’s ability to facilitate data-driven technologies is bringing us closer to the smart farming industry of the future. With its stable and trustworthy data storage capabilities, combined with the power of smart contracts, blockchain is smoothing out the process of transactions between multiple parties and making the entire process faster and more efficient.

Application and uses of Blockchain in Agriculture

Blockchain technology is revolutionizing the agricultural industry by providing new and innovative ways to improve efficiency and transparency. In this article, we’ll take a deep dive into some of the most exciting uses of blockchain in agriculture.

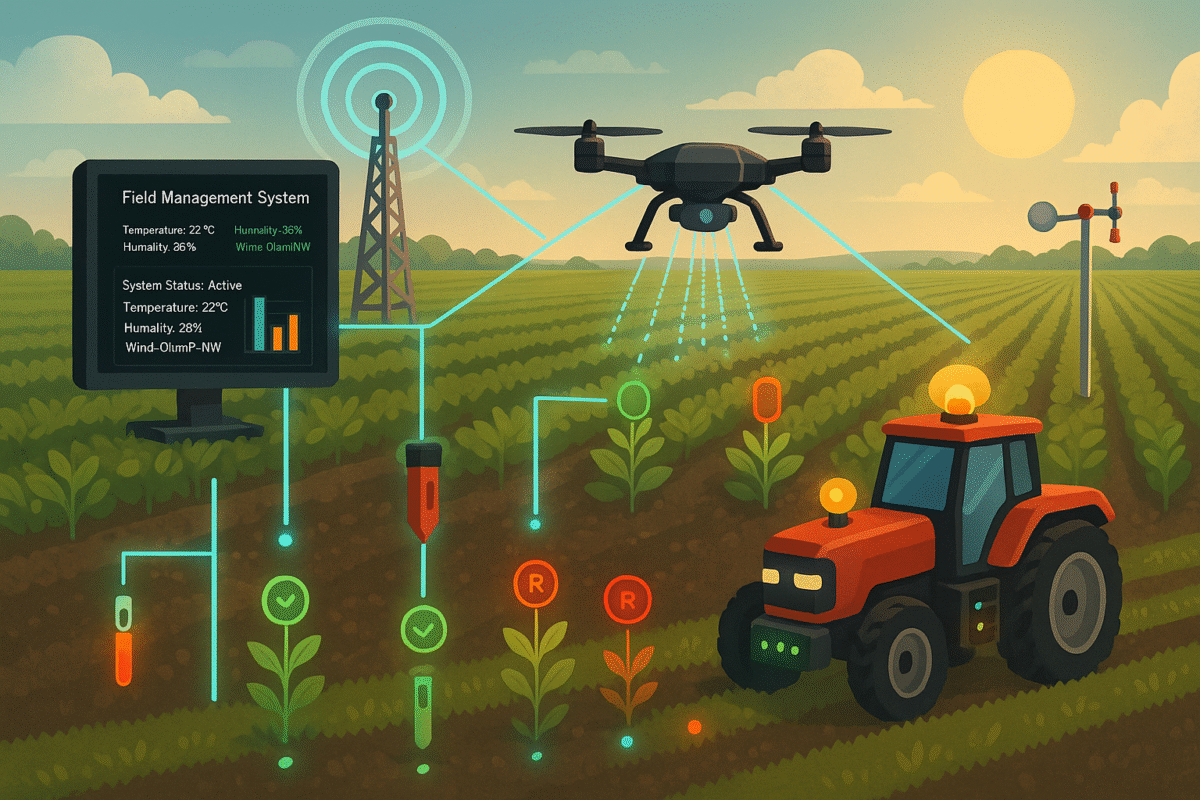

Imagine being able to incorporate cutting-edge technology, like sensors, machine learning, and data analysis tools, into your farming operations. This is the concept of “smart farming,” also known as “smart agriculture.” It’s all about using technology to make farming more precise, efficient, and reliable. But, as with any new technology, there are always challenges to overcome.

Traditionally, the management systems for smart farming have been centralized, which can lead to errors in data collection and increases the risk of cyber-attacks. That’s where blockchain technology comes in. By using blockchain, we can securely store data from seed to sale, and allow all players in the process to generate and access the necessary environmental monitoring data at any point along the way. Blockchain’s decentralization is its greatest strength in smart agriculture, as it simplifies data sharing and reduces the risk of data loss and distortion.

There are many exciting projects and solutions currently being developed to take advantage of the power of blockchain in agriculture.

The future of agriculture is looking brighter than ever before, thanks to blockchain technology. With its ability to increase efficiency, transparency, and security, we can look forward to a smarter and more sustainable agricultural industry.

Unleashing the Power of Blockchain in the Agricultural Food Supply Chain: A Revolution in Traceability and Efficiency

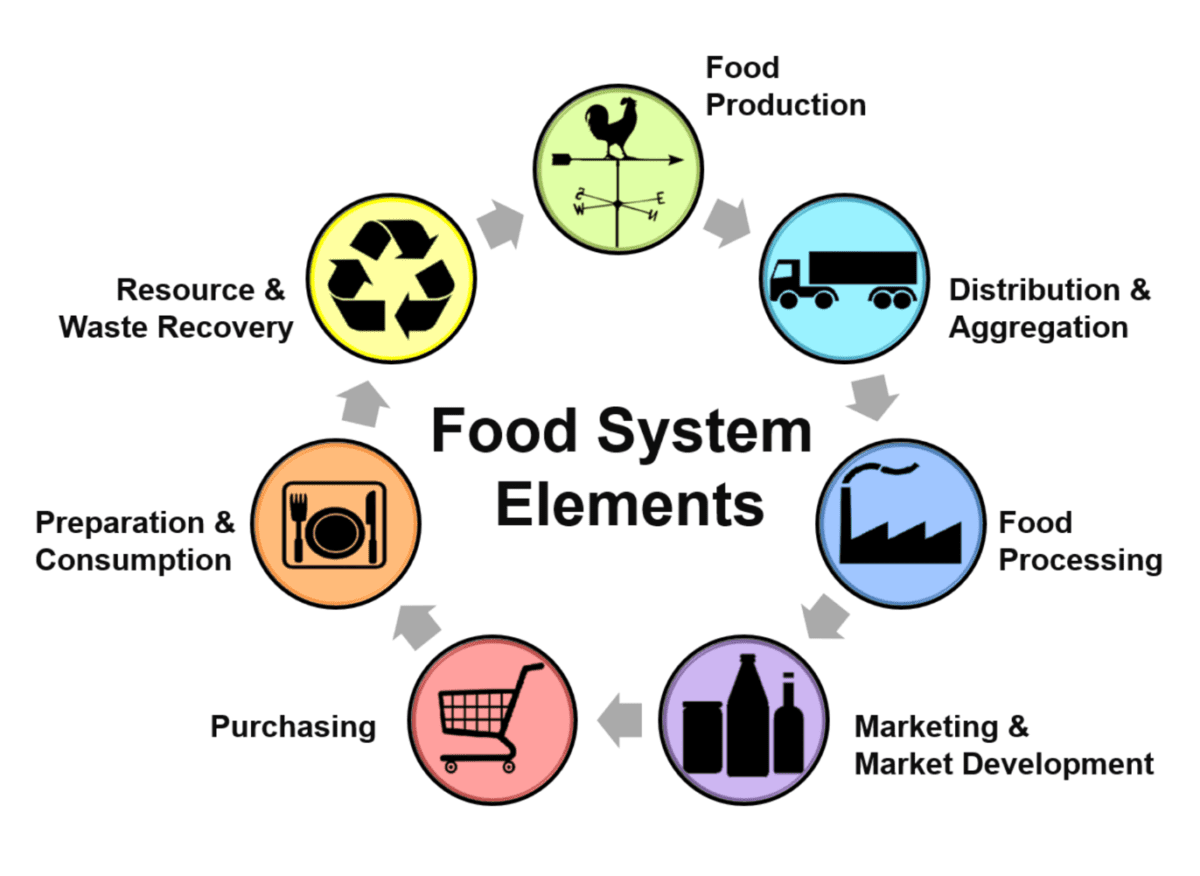

In today’s globalized world, the food supply chain in the agriculture industry has become longer and more complex than ever before. But with this increased complexity comes a host of challenges, from concerns about food security and quality, to issues of traceability, trust, and supply chain inefficiencies. These challenges weigh heavily on the economy and society, and put the health of customers at risk.

Enter blockchain technology, the game-changer that resolves many of these difficulties. With blockchain, trust is established between producers and customers by providing specific product data within the blockchain. This greatly improves transparency in the food supply chain process.

The benefits of blockchain technology are far-reaching for both corporations and farmers. It empowers businesses to raise the value of their goods and increase their market competitiveness. It also makes it nearly impossible for low-quality or fake goods providers to continue their deceitful practices.

Think of it as a digital watchdog that guards the food supply chain and make sure that only high-quality and authentic goods make it to your plate. Blockchain technology is bringing a new level of trust and transparency to the agricultural industry, and it’s an exciting time to be a part of it.

Revolutionizing Agriculture: Unlocking the Potential of Blockchain in Supply Chain Management

The food supply chain has become a tangled web of complexities due to the global nature of our food system and the intense competition in the market. Inefficiencies such as traceability, safety, quality, trust, and supply chain inefficiency, pose a significant risk to society, the economy, and human health. Smart contracts play a crucial role in ensuring a smooth and efficient food supply chain system.

Blockchain technology has the power to alleviate many of these issues by helping manufacturers establish a trusting relationship with customers by providing transparent and accurate information about their products on the blockchain. This not only improves the reputation of the products but also helps to boost the competitiveness of the businesses. It also makes it difficult for fraud and low-quality product providers to survive, ultimately driving all suppliers in the agricultural and food industries to improve their product quality.

From the consumer standpoint, blockchain gives accurate and reliable information about how food is produced and traded, addressing concerns about safety, quality, and environmental sustainability. It enables customers to better understand the food production process and connect with farmers, thus fostering consumer trust and confidence in food safety. For regulatory authorities, blockchain provides transparent and accurate supply chain data that allows them to implement informed and efficient policies and even aid in crop insurance.

While blockchain technology is rapidly evolving, it still has a long way to go in transforming the food supply chain. Its implementation in the food supply chain still faces challenges, such as a lack of widespread engagement and collaboration from all stakeholders, and immature and flawed areas in the deployment process. Furthermore, it is critical to study the motivations of the parties involved to contribute accurate data to the blockchain, particularly for small-scale farming, as the benefits of blockchain may vary depending on the size of the farm.

In conclusion, blockchain technology has the potential to revolutionize the food supply chain by providing transparency, security, and decentralization. It helps in preventing food fraud, reducing supply chain management costs, improving food safety and traceability, enabling smart farming and smart index-based agriculture insurance, and provides new revenue streams. However, its implementation is still in its early stages and further research is needed to understand its full potential and limitations.

Harvesting the Benefits: How Blockchain is Transforming Agricultural Insurance

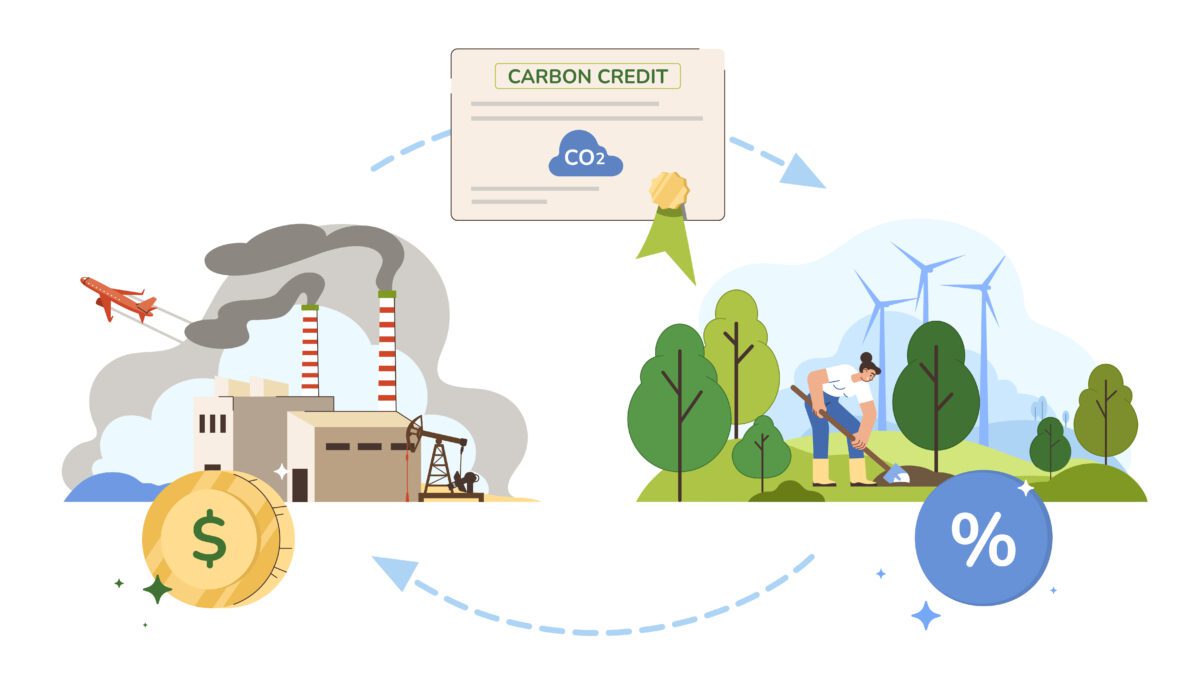

Climate change has thrown the agricultural industry into a state of uncertainty, with extreme weather events taking a toll on the quality of crops and cattle. To combat this unpredictability, farmers often turn to agricultural insurance schemes as a safety net.

Farmers pay a small insurance fee at the start of each growing cycle, and in return, they are compensated if their farms suffer losses due to unpredictable weather conditions. This gives farmers a sense of security as they navigate the unpredictability of weather patterns and the vagaries of the supply chain.

With various insurance policies to choose from, farmers can pick a policy that suits their needs the best. However, traditional insurance policies often have difficulties relating to damage assessment and lack of insurer information, causing headaches for both farmers and insurance companies.

But what if I tell you there’s a technology that can change all that? Blockchain technology has the potential to transform a variety of industries, and the agricultural industry is no exception. Blockchain can aid the advancement of index-based insurances in a couple of ways.

First, payments could be based on real-time and automatic criteria like weather data. For example, if a certain temperature threshold is reached, it would trigger a payout to the farmer. Smart contracts can specify these terms exactly.

Secondly, with a smart oracle, all data sources, such as weather data and plant growth information, can be automatically used in the insurance scheme, which significantly improves the payment process and index determination.

It’s an exciting time for the agricultural industry as blockchain technology is providing new ways to mitigate risk and uncertainty. It’s a game-changer for farmers and insurance companies alike.

Blockchain-Powered Data Storage

Picture this, with the help of a blockchain developer, buying and selling agricultural products on e-commerce sites becomes a breeze, thanks to the power of blockchain technology. Imagine a world where information protection, food supply chain management, agricultural supply chain data storage, decentralized crop insurance and reduced transaction costs are all a reality.

When it comes to data security, blockchain has your back. It offers the vital feature of private key encryption, which strengthens the validity of the authentication process. This ensures that all data collected throughout the planting and harvesting stages is kept safe and secure.

In terms of supply chain management, blockchain acts like a conductor, orchestrating the flow of information and transactions between all parties, leading to increased efficiency and lower costs. This can also help to improve traceability and transparency, allowing you to know the exact origin of your produce.

And let’s not forget the payment process, which becomes a seamless experience. Blockchain technology enables digital payment solutions with zero transaction costs, and the integration of cryptocurrencies can further reduce the costs, allowing you to save more.

All of these features contribute to increasing customer trust in the e-commerce process of buying agricultural products. This not only benefits farmers by increasing their revenue and reach to a larger audience, but it also empowers customers to make informed decisions about the food they consume.

In short, blockchain technology has the power to revolutionize the agricultural industry by improving data.

Blockchain for Better Bites: Revolutionizing Food Production with this innovative technology

Blockchain technology is a game-changer for the food industry. It offers transparency, security, and decentralization to an industry that desperately needs it. With blockchain, transactions are recorded and stored immutably, meaning that every modification is tracked and exposed to the entire network, making it impossible for transactions to be altered or disguised.

Think of blockchain as a digital ledger that records all the information about the food production process, stored in a distributed fashion across multiple networks that all members can access and read. This creates a transparent environment where trust is no longer necessary and there is no need for a central authority to mediate between parties.

This is especially important when it comes to detecting food tampering, fraud, and deceptive advertising. It also helps with large-scale recalls of hazardous goods, reducing food waste in supply chain networks and preventing food spoilage, and allowing businesses to confirm organic or fair-trade origins.

However, implementing blockchain technology in the food production industry does come with its challenges. Understanding the complexity of the food ecosystem and creating a tailored system that can handle different shapes, sizes, storage systems, handling processes, and data recording methods can be a barrier for newcomers to the field.

Another issue is data transparency, as it can be a double-edged sword. On one hand, it can provide accountability and improve transparency in the agricultural industry, but on the other hand, it can lead to backlash against corporations if something goes wrong. And as we all know, blockchain technology needs to handle large amount of data and properly plan out the structure and scaling of the network.

Blockchain technology has the power to revolutionize the food production industry, making it more transparent, secure and efficient. It may be a bit challenging to implement, but with the right approach, it can bring a whole new level of transparency and trust to the food industry.

Summing It All Up

Blockchain technology is on the rise and showing no signs of slowing down. It has the potential to shake up multiple industries, but the agriculture market is particularly ripe for disruption. With a global value of over 2.4 trillion dollars and over one billion employees, the possibilities for innovation are endless.

Think of blockchain in agriculture as a tool for streamlining and modernizing the entire supply chain process. Smart contracts, big data, crop insurance, and unmanned aerial vehicles are just a few examples of how blockchain can be utilized to track and improve efficiency in the food production process.

Imagine being able to trace the exact origin of your produce, all the way from the farm to the grocery store. Smart contracts can revolutionize the way agricultural supply chains operate by using the data collected through crop insurance schemes to boost overall supply chain management.

In short, if you’re an agricultural supply chain looking to increase efficiency, implementing a private, local blockchain to track and manage your data is the way to go. With live access to information collected throughout the entire food production process, your supply chain will be able to operate with precision and transparency.Top of Form

Yet, perhaps the most alarming aspect is the elevated risk of suicide within the farming community. Distressing statistics reveal that farmers bear one of the highest suicide rates across all occupations. Farmers have one of the highest suicide rates across all occupations.

Yet, perhaps the most alarming aspect is the elevated risk of suicide within the farming community. Distressing statistics reveal that farmers bear one of the highest suicide rates across all occupations. Farmers have one of the highest suicide rates across all occupations.