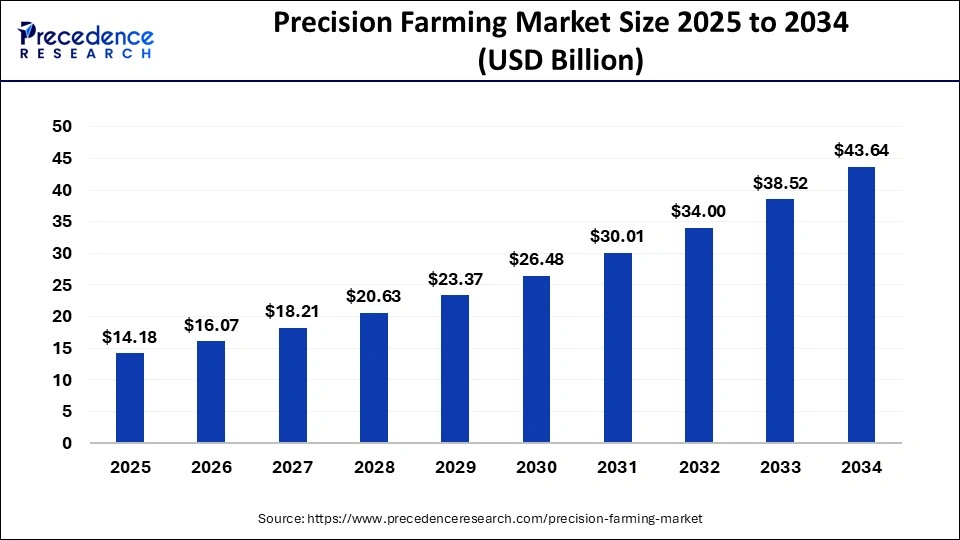

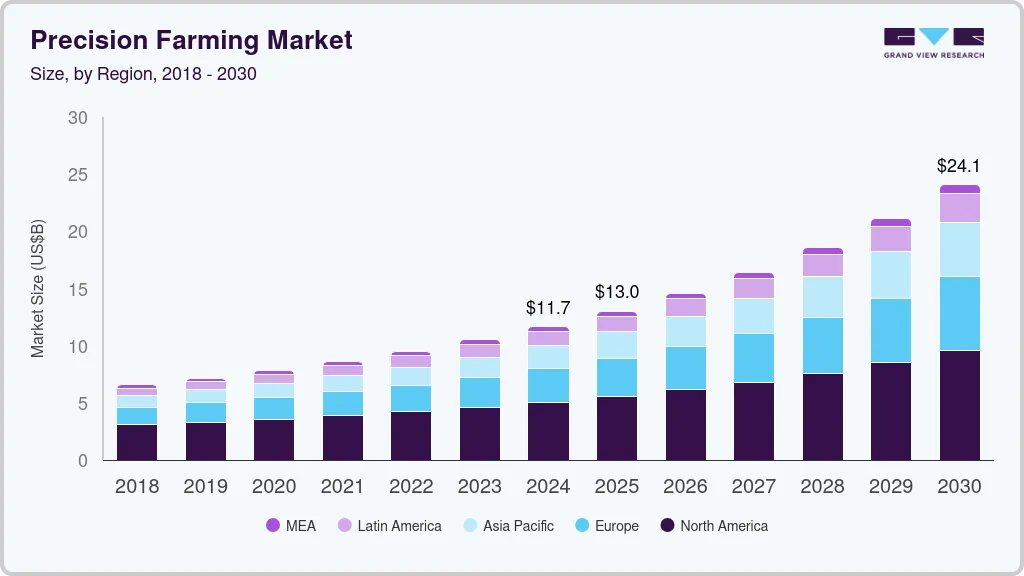

The global precision farming market reached approximately $11-14 billion in 2024 and is projected to grow to $21-49 billion by 2032-2034, depending on market estimates. Growth rates hover between 9-13% annually, driven by the integration of IoT sensors, artificial intelligence, and automated farming equipment.

North America commands roughly 44% of the global market, with the United States alone accounting for significant investment in GPS-guided machinery, drone technology, and sensor networks. The region benefits from established agricultural infrastructure and government support programs, though adoption barriers remain for smallholder operations.

Technology Segments

Variable rate technology (VRT) enables farmers to apply water, fertilizers, and pesticides with field-zone precision, reducing input waste. Yield monitoring systems provide real-time crop performance data during harvest, allowing farmers to build historical databases that inform planting decisions and demonstrate environmental compliance.

Hardware—including sensors, GPS equipment, and drones—currently generates the largest revenue share, though software platforms for farm management and predictive analytics are growing faster as cloud-based solutions become more accessible.

AI and IoT Integration

Research published in peer-reviewed journals shows that IoT sensor networks now continuously measure soil moisture, temperature, humidity, and plant health. These data streams feed machine learning models that optimize irrigation schedules and nutrient application. The integration addresses labor shortages and helps farms respond to climate variability.

Market Barriers

High upfront costs for advanced equipment remain the primary obstacle, particularly for small and medium-sized farms. A 2024 US Government Accountability Office report found that only 27% of U.S. farmers use precision agriculture technologies, despite many having been available since the 1990s. Technical complexity and uncertain economic returns also slow adoption.

Regional Dynamics

Asia-Pacific is emerging as the fastest-growing market, with adoption accelerating in China, India, and Australia. Government initiatives play a key role—India announced plans in 2024 to invest $650 million in precision farming technologies. Europe follows North America in adoption rates, supported by sustainability policies and smart agriculture incentives.

Looking Ahead

Scalable solutions targeted at smaller operations through leasing models and service-based platforms could expand market reach. Weather tracking and forecasting applications are growing at the highest rates (around 17-18% annually), as climate change increases demand for hyperlocal weather data. The shift toward data-driven agriculture continues, though connectivity gaps in rural areas and data interoperability challenges require attention.