The global pork sector is entering a period of cautious stance. According to the RaboResearch quarterly report, weak growth in breeding herds, unsettled trade flows and recurring animal-health threats are combining to temper expansion across key producing regions.

Herd Numbers Holding Firm — Then Contracting

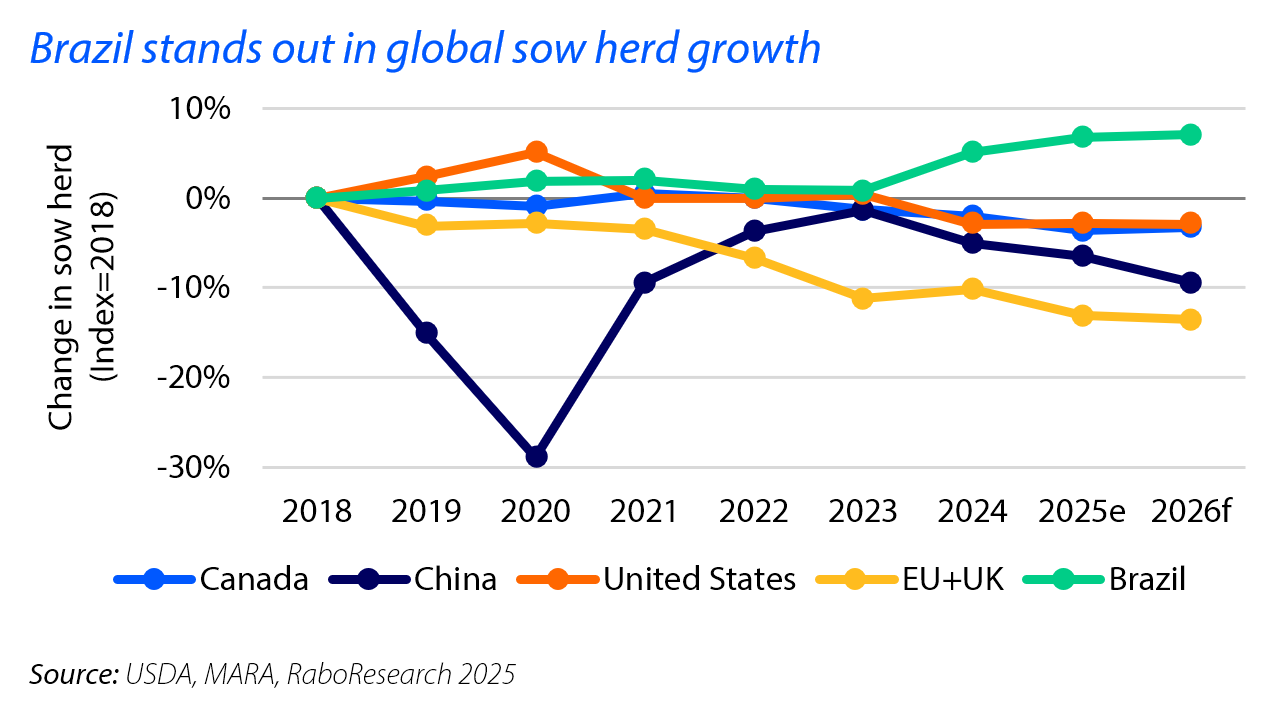

The report forecasts a slight contraction in the global sow herd in 2026. Producers are signalling reluctance to expand breeding inventories given the constellation of risk factors.

Specifically, China has announced a reduction of roughly one million sows — about 2.5% of its domestic breeding base — which translates into around a 1% decline in the global sow herd in the coming year.

At the same time, Brazil is showing continued expansion in its sow herd, driven by favourable margins and strong export momentum — a development that will only partially offset the drag imposed by contractions elsewhere.

Trade Flows Under Pressure, But Some Gains

Global pork trade volumes rose around 3 % year-on-year through June, with full-year 2025 expected to end roughly flat or slightly ahead of 2024.

In this field, Brazil emerges as one of the few clear winners: its share of global pork export volume is projected to rise from about 12% to 15% by 2025, thanks to its proactive access-strategy and export diversification.

However, trade remains highly unsettled. Major producers such as the US and the EU face ongoing friction in export markets (notably China) and shifting regulatory regimes. This adds to the uncertainty around future volume growth.

Disease & Health Risks

Animal health remains a major constraint on production. Outbreak‐related losses in 2025 have squeezed supplies in many leading pig-farming regions.

For instance, African swine fever (ASF) continues to be a major concern. Vietnam reported over 970 cases in 2025 and more than 100 000 pig mortalities according to available press summaries.

Europe has also seen new commercial-herd ASF outbreaks (Germany, Romania) alongside ongoing issues with Porcine reproductive and respiratory syndrome (PRRSv) and Foot-and-mouth disease (FMD), especially in North America and Europe.

While the industry reports modest improvement in herd health metrics moving into 2026, the risk of the next outbreak remains real given global trade flows and mixed bio-security regimes.

Pricing & Profit Margins

In many regions, pork prices have strengthened because demand growth is outpacing supply. For example, inventories in the EU and North America have fallen, leading to price increases of approximately 10% and 21% year-to-date respectively.

On the flip side, China is showing a 42% year-on-year drop in pork prices—largely driven by improved production efficiency even amid a cautious breeding herd expansion outlook.

However, inflationary pressures and consumer affordability remain key moderating factors. While pork consumption holds up better than many alternative meats, a constrained household budget in late 2025 and early 2026 could dampen growth.